The much talked about Polygon MATIC cryptocurrency platform is directed and discussed to provide a thorough guide to this relatively new kid on the block

When Bitcoin first arrived on the scene in 2009, it was heralded as the future of money. Those lucky enough to have bought into it at the very beginning certainly made a killing. From an original value of $0.0009, it rose rapidly. Despite its volatility in recent years, those early investors made many millions.

Fast forward six years, and Ethereum arrived on the scene. To the outsider, Ethereum is just another cryptocurrency. However, it is much more than that. Ethereum is not simply another currency in competition with Bitcoin. Instead, it has different goals, different values, and even different technology behind it.

Ethereum is a decentralized blockchain network. Powered by Ether tokens, its users can make transactions and earn interest by staking, trading non-fungible tokens (NFTs), cryptocurrency, playing games, participating in social media projects, and much more.

Vitalik Buterin, Ethereum's inventor, realized that there was a much-needed gap in the internet experience. It was his dream to have a system that was fully autonomous, totally transparent, and free from any central governance.

Big businesses, like Google or Microsoft, control how the internet works. As soon as users give their personal details to an online company, that information is stored on a server. This system means that your information is always at risk from hackers and incurs high costs, which ultimately you pay.

Ethereum broke the mold of internet technology. With no central governance, there is no third party involved at all. Instead, Ethereum permits software applications to run on a network of many privately owned computers. In this decentralized system, the extensive network of small computers replaces the old company computers and cloud servers. Volunteers run the entire system from all over the globe.

It is essential to realize that not even Ethereum's owners can control the network. Instead, a community of users entirely runs it.

Russian-born Canadian Vitaly Dmitriyevich "Vitalik" Buterin is a programmer and writer who became involved in cryptocurrency very early on. He co-founded Bitcoin Magazine in 2011 before launching Ethereum in 2014.

Buterin was born in 1994 in Kolomna, Russia. His father was a computer scientist who moved to Canada when Vitalik was six years of age. Vitalik immediately demonstrated academic brilliance and was placed in a class for gifted children within a couple of years. He excelled in mathematics, programming, and economics.

Buterin went on to attend The Abelard School, a private high school in Toronto, and then on to the University of Waterloo. His academic brilliance again shone through, and he became a research assistant for cryptographer Ian Goldberg. In 2012 he won the bronze medal at the International Olympiad in Informatics in Italy.

In 2014 he dropped out of university after obtaining a grant of $100,000 from the Thiel Fellowship. At this point, he turned all his attention to Ethereum.

2013

Ethereum was first conceived by Buterin, along with Englishman Gavin Wood, American Charles Hoskinson, and two Canadians, Anthony Di Lori and Joseph Lubin.

Buterin first published the Ethereum white paper. In it, he detailed smart contracts which would enable the development of decentralized applications (Dapps). Dapps already existed at this point, but the platforms in the blockchain space needed to be interoperable. It was Buterin's dream to unify them using Ethereum.

2014

In January, the co-founders announced Ethereum at the North American Bitcoin Conference in Miami. After that, work began on the development of the Ethereum project. First, they set up a crowdfunding page, and fundraising started earnestly. Buterin chose the name after looking at a list of science fiction elements on Wikipedia. He liked it because "I immediately realized that I liked it better than all of the other alternatives that I had seen; I suppose it was the fact that [it] sounded nice and it had the word 'ether,' referring to the hypothetical invisible medium that permeates the universe and allows light to travel."

Buterin and his partners developed several codenamed prototypes of Ethereum over eighteen months. Their proof of concept series finished with "Olympic" being the last prototype.

2015

The Ethereum "Frontier" protocol network went live on July 30th. The Genesis block had 8,893 transactions allocating different amounts of ETH to various addresses.

2016

A DAO developed on the Ethereum platform raised a staggering $150 million in a crowd sale. A DAO or Decentralized Autonomous Organization is an organization built following rules encoded as a computer program. DAOs are often transparent; they are controlled by their members and not influenced by any central government.

In May 2016, the platform was famously hacked and drained of $50 million. The company quickly reversed the hack, but this caused a split, creating two blockchains. Many of the original miners switched to a new hard fork on the Ethereum Blockchain; the original chain became Ethereum Classic. A rivalry grew between the two factions, and towards the end of the year, Ethereum forked two more times to deal with more attacks.

2017

In March of this year, a group of various blockchain startups, research groups, and Fortune 500 companies launched the Enterprise Ethereum Alliance (EEA). The Alliance had 30 founding members, which rapidly grew to 116 enterprise members by May of the same year.

2018

At the start of this year, Ethereum was the second largest cryptocurrency after Bitcoin. It has remained in that position ever since.

2020

Ethereum announced that ETH 2.0 would see the network transition from a Proof of Work platform to a Proof of Stake. It would happen in phases. The first of these upgrades, called "phase 0", launched their proof-of-stake Beacon Chain on December 1st.

2022

As the Beacon Chain arrived earlier than expected, Ethereum announced that 2022 would be the year that saw the Merge take place. Early in 2022, they dropped the term Eth 2.0 to promote the idea of just one Ethereum network and cryptocurrency. The Eth1 blockchain was renamed the execution layer, with Eth1 clients reclassified as execution clients. Eth2 blockchain was renamed the consensus layer, and Eth2 clients were reclassified as consensus clients. This was the full realization of a Proof of Stake platform and on the 15th of September, the Merge happened.

A decentralized network like Ethereum works in a completely different way from what we are used to with the internet. Social media platforms are owned and run by large companies. Take messaging on a smartphone, for example. When two people message each other on a smartphone, the message goes via an App like Facebook, Skype, to WhatsApp. Once sent, your message goes through the company server and is out of your control.

Now, imagine the same message sent through the Ethereum messaging app. The network is not owned or run by any central authority or big company. Instead, the message goes via a network of computers around the world. However, it is completely hidden from the network. Decentralized apps use smart contracts which work autonomously without any middlemen. The rules of the smart contract are predetermined and cannot be changed.

The architectural components of the Ethereum blockchain are a complicated protocol of elements and qualities. This protocol creates an ecosystem of all-encompassing solutions, including decentralized finance (DeFi) products, decentralized exchanges (DEXs), and others.

The Ethereum blockchain operates entirely autonomously from all other blockchains, for example, the Bitcoin blockchain, Genesis Block. Ethereum has its own coins and trades on crypto exchanges under the ticker ETH. ETH is sometimes called Ether and is used in various ways in crypto.

If you buy a product through Ethereum, you pay for the cost of the product, and the vendor dispatches the product. If you do not pay enough, the order does not go through. The order only goes through if the product is in stock. It's fast, safe, and anonymous. Even better, the platform can set the preconditions to whatever is needed. For example, if you attend a concert and buy tickets on the Ethereum network, you are guaranteed your ticket. If, for any reason, the show is canceled, you automatically get a refund.

Using smart contracts and the Ethereum blockchain removes the need for expensive third parties. Two complete strangers can transfer money or products without the need for trust.

Originally Ethereum was a Proof of Work (PoW) protocol. PoW means that new coins had to be created by mining. The downside of mining is that it takes an extraordinary amount of computing power and is, therefore, very energy inefficient. So, in September 2022, the platform merged its Mainnet with its Beacon chain to create a Proof of Stake chain. Proof of Stake (PoS) means it reaches a consensus on its own state by agreeing on active validators and their account balances. As a result, none of the platform's history was lost, and users saw no change to their accounts. Furthermore, Ethereum now operates at a much more cost-effective level.

Every time a user performs an action, they interact with the network. Ethereum then pays a transaction fee to its validators to process that transaction. This payment is known as a gas fee. Users have to pay gas fees to enable Ethereum to operate. While many people think that these fees are revenue for Ethereum, in fact, most of them are burnt away, and only the surplus is paid to the validators. Ethereum in itself doesn't make money.

Decentralization

The whole ethos of a decentralized network is that there is no central governing body. This fact completely removes the need for trust between network members.

Size of the network

Ethereum functions with hundreds of nodes and millions of users. Most of its competitors have less than ten nodes and simply cannot compete on the same scale.

Rapid Deployment

The network performs transactions in an instant. The blockchain uses a Software as a Service (SaaS) platform which performs all transactions at lightning speed.

Transparency with Privacy

A user's private information is encrypted and is only shared with those who need to know. The platform conducts its business in a transparent manner without compromising the user's privacy.

Finality

Using smart contracts means that once created, the blockchain is immutable. This provides much security for users. They can operate safely, knowing that the transaction will only be finalized once all preset conditions are met.

Industry Standards

Ethereum maintains an extremely high bar of operating standards. The ecosystem cannot fragment because it uses protocols for token design, human-readable names, decentralized storage, and decentralized communications.

Complicated Programing Language

The system uses an operating language that is extremely complicated, and many express concerns about the need for more beginner-friendly classes.

Scaling Issues

Ethereum has its platform for smart contracts and a ledger. However, unlike Bitcoin, which has a singular purpose, this can lead to errors and is more at risk from hackers.

Volatility

From an investment point of view, Ethereum is a volatile and, therefore, risky proposition. Investors have seen both significant gains and significant losses over time.

Decentralized Finance (DeFi) removes third-party and centralized governance from all financial transactions. The DeFi infrastructure is constantly evolving.

Stablecoins peg their market value against an external reference; this could be fiat money like the USD or gold. Most stablecoins are less volatile than other cryptos.

Non-fungible Tokens (NFTs) may be a piece of artwork, real estate, music, or much more. Converting a file into an NFT secures them via blockchain technology, thus making buying, selling, or trading very efficient and, at the same time, reducing fraud considerably.

Decentralized Autonomous Organizations (DAOs) are community-led entities with no central authority. They are both transparent and fully autonomous because smart contracts perform under strict rules and execute preset decisions. All this is open to public audit at any time.

Decentralized Apps (dapps) are digital applications running on a blockchain. They use a network of computers instead of relying on a single device. The decentralized nature of dapps means they are free from the interference of a single authority.

Decentralized Identity, sometimes called self-sovereign identity, uses self-owned verifiable credentials and digital identifiers. In addition, they are wholly independent and therefore enable trusted data exchange.

Social Networks run on Ethereum are blockchain-based platforms allowing users to exchange information and publish and distribute content. They are decentralized and, therefore, resistant to censorship and undue control.

Play-to-earn gaming (P2E) is a rapidly growing sector of the crypto industry. They allow users to earn crypto and NFTs, which they can trade on the market, to make money while playing games.

Supply Chain Management on a blockchain ledger provides trusted and tamperproof audit trails of the supply chain. Furthermore, they can maintain all aspects of information, inventory, and finance flow.

Fundraising through Quadratic Funding is a mathematical, democratic, and scalable way of raising funding for public goods.

Smart Power Grid has automation, communication, and IT systems enabling it to control the power flow from generation to consumption. These are incredibly accurate at curtailing the load to match generation in almost real time.

ETH still performs very well in comparison to bitcoin when looked at purely as a cryptocurrency. However, Ethereum is a lot more than just a crypto. While Ethereum does have ETH as its cryptocurrency, it was primarily built for smart contracts and dapps. Ethereum uses blockchain technology so that customers can make decentralized payments through the tamper-free storage of computer code. Bitcoin and ETH are the two most prominent cryptocurrencies currently available.

The most popular way for investors to buy ETH is via a crypto exchange like Coinbase, Binance, Kraken, and many more. While some mainstream brokerage platforms like Paypal or Robinhood offer this service, the marketplaces are the simplest way to go.

If you wish to buy ETH, you must first choose which exchange you want to use. Next, you must pick an exchange that works in your region and register with it. Some exchanges require more personal information than others. Then you connect your bank or debit card to fund the account. Some exchanges permit the use of fiat money in addition to crypto.

You will also need to buy a crypto wallet. There are many different types of crypto wallets available. Each type has different levels of security, so choose wisely.

There are different ways in which to purchase ETH. Various regulations govern online peer-to-peer (P2P) purchasing depending on geographical regions. Remember that these exchanges still involve "know your customer" (KYC) and "anti money laundering" (AML) processes. Exchanges that allow P2P facilitate "over the counter" (OTC) dealing. These exchanges generally use an escrow feature.

Sometimes, dealers meet each other in a public place to make transfers. Again, it is imperative that you know the person you are dealing with in these cases. Treat them exactly as you would if making a significant transfer of traditional fiat money.

Once you have started purchasing ETH, selling it is easy. Pick a crypto exchange. Make sure your bank account is connected to your exchange, transfer ETH, and sell against your preferred currency. Then simply withdraw the money.

Briefly, a crypto wallet is a device that enables interaction with a blockchain. They don't really store your cryptocurrency but act as a gateway that provides the necessary information needed to access cryptocurrencies. Your wallet is your key to crypto dealing; it offers proof that you are exactly whom you say you are.

The safest types of wallets are hard wallets. These are physical pieces of hardware that connect to your computer when you need to trade.

Metamask is the most widely used ETH wallet on the market. As well as enabling the storage and sending of Ethereum, it also allows access to decentralized Ethereum applications. Most customers find the Metamask wallet extremely intuitive. Other popular wallets include Ledger Nano X, Trezor, Coinbase Wallet, and MyEtherWallet.

All cryptocurrencies come with a certain level of risk. They are volatile and subject to wild fluctuations at times. However, Ethereum is different from many cryptocurrencies. Companies are using it as a building block for the future. Therefore, long-term investing is the best way to view it. For individual investors, it is easy to buy ETH, then sit on it while keeping an eye on how it behaves. This buy-and-hold strategy is known as holding.

Staking is an excellent way to earn ETH. As long as you have enough cryptocurrency in your wallet, Ethereum enables its users to join in the Proof of Stake process. Since the Merge to ETH 2.0, this process of participating in transaction validation on the blockchain has been available.

A simple way for newcomers to earn some money with Ethereum is to participate in "bounties" and "airdrops." Bounties are small online tasks that pay a small fee in ETH for your participation. Popular categories of bounties include; making YouTube videos, Tweeting, or writing articles. You can search for these bounties on platforms like Bounty0x or look them up on crypto forums.

Airdrops are free coins sent to your wallet by projects trying to build a community. Often these are paid into your wallet without you doing anything. However, to find the most lucrative airdrops, you must research and then participate manually. Airdrop Alert is an excellent place to start looking.

Any creatives can make serious money with Ethereum's use of dapps. Users can monetize almost anything these days. Works of art, music, videos, ticketing, emojis and all kinds of created works now generate money using the Ethereum network. By converting your work to NFTs, you can monetize it.

Take advantage of Decentralized Finance and earn a passive income. Some protocols offer an annual percentage yield on your investment. In addition, if you have available funds, you can make money by lending. A considerable advantage of DeFi lending is that the entire lending and borrowing process utilizes smart contracts. As a result, the risk from defaulted payments is virtually zero. Also, most DeFi lending platforms permit you to withdraw your crypto at any time with no exit fees.

1: Know Your Stuff

The first and most important tip we can offer is to understand Ethereum fully before you start thinking about investment. Like traditional investments, it is imperative that you know your market. There is a vast potential to make money here, but conversely, traders can incur significant losses.

The decentralized nature of Ethereum makes it a desirable proposition. It provides a more secure investment than traditional stocks and bonds as it is not subject to economic conditions. The more you learn, the better you will become. Knowing when to buy and sell is all part of the process. Panic buying and emotional decisions never work.

2: Diversity

Learn to diversify your portfolio. There is no need to put all your eggs in one basket, particularly when you see the many different forms of investment that Ethereum offers. This kind of investment mitigates your risks and enables you to learn more about the cryptocurrency market as you go.

3: How Much to Risk?

The golden rule of any investment is that you should never invest more than you can afford to lose. Never, ever overexpose yourself financially. Of course, the temptation to take a big gamble will always be there, but this is precisely how fortunes are lost. So be patient, think about the long game, and enjoy your trading.

Compound

Compound is an app that developers use to unlock a myriad of open financial applications. It allows users to deposit cryptocurrency into lending pools that borrowers can access. Lenders, in turn, earn interest on their deposited assets.

Uniswap

Uniswap is the largest decentralized exchange operating on Ethereum's blockchain. It facilitates the trading of crypto worldwide without an intermediary.

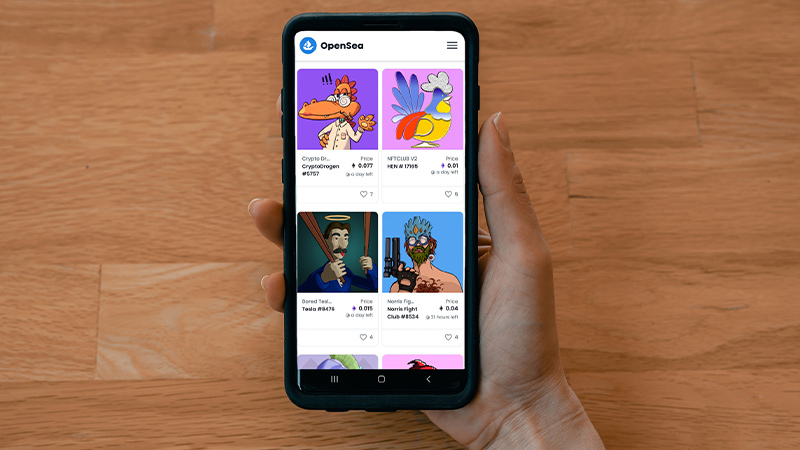

OpenSea

OpenSea was the world's first (and still is) the largest web3 marketplace for NFTs and digital collectibles. Users can utilize this app to browse, create, buy, sell, and auction NFTs.

ENS

ENS is the most used blockchain naming standard. This app maps human-readable names to machine-readable identifiers such as Ethereum addresses, crypto addresses, content hashes, and metadata.

PoolTogether

PoolTogether is a crypto savings protocol based on Premium Bonds. Users have the chance to win every day while saving money.

CryptoKitties

CryptoKitties was a game changer, one of the world's very first blockchain games. With almost 100,000 kitty owners it is the most significant non-financial app on the blockchain.

Gods Unchained

An extensive collectible app, Gods Unchained is a trading card game giving players ownership of their collections. Users can play for free, play for keeps, or trade in the open marketplace.

According to Founder Vitalik Buterin, Ethereum's next focus will be improving scalability. He states, "Sharding is the next step that isn't quite here yet." Sharding is a type of horizontal scaling bringing in additional nodes, which can then handle more intense workloads.

The next step for Ethereum will be "The Surge." The Surge will consist of a series of events intended to permit the Ethereum network to process tens of thousands of transactions every second. As Buterin puts it, "There are a lot of smart people that are working on approaching the problem…at multiple layers of a stack from different angles."

Ethereum has become one of the truly serious players in the crypto world. There is no sign of its place in crypto abating. The platform is innovative and subject to continual growth and development. Buterin is a highly driven individual, and the company has a bright future with him at the helm.

Vitalik Buterin is a firm believer in Proof of Stake as the future of crypto networks. He thinks that more companies will change over to this energy-efficient protocol. "As proof of stake matures, I expect it to just increase in legitimacy more and more over time. I hope that Zcash moves over, and I am also very hopeful that Dogecoin will want to move over the proof-of-stake at some point as well, especially now that there is a clear roadmap for how something like that can be done," he stated.

Whitepaper, first published in 2014, before Ethereum's launch in 2015, lays out the company's future as a community-driven, open-source software project. Despite its age, it remains a valuable resource for learning about Ethereum's vision.

Community Hub is where hundreds of thousands of Ethereum enthusiasts and users chat with developers, technicians, and designers. There are also opportunities to earn through meaningful work.

Into The Ether is a podcast that discusses all things Ethereum and DeFi. The site has in-depth discussions with terrific guests and weekly news recaps.

Truffle Suite is a comprehensive tool for the development of smart contracts. Truffle manages your contract artifacts and includes support for custom deployments, library linking, and complex Ethereum apps.

As always, we remind you not to take this article as investment advice. Instead, we suggest that readers do as much research as possible. There is plenty of material out there to explore, so take the time to dig in. However, it would be cool if you follow us on Twitter to get updates, weekly news bulletins, guides, and much more. So keep it sensible and happy trading.

The much talked about Polygon MATIC cryptocurrency platform is directed and discussed to provide a thorough guide to this relatively new kid on the block

The ultimate guide to Bitcoin, its place in the cryptocurrency world, and how you can get involved should you wish. A comprehensive look at Bitcoin.